Chronicle of a Collapse Foretold (Which Still Doesn’t Have to Happen) Part 3

Who Donnit?

Asking who had a motive to bring about this supposed viral pandemic is like asking who donnit in Murder On the Orient Express. Everybody had a motive. Every ruling class, every sector of ruling class society has reason for welcoming the CV into their societies. The EU has seen nothing but hardship and political turmoil over the years: Brexit, Scottish nationalism, Catalonia, austerity, migrants and opposition to the Union itself. Zero Hedge reports China quietly injected a record $5.2 trillion into its once exponentially thriving economy.

With China scrambling to reboot its economy after the record collapse in February as the coronavirus epidemic paralyzed the country, two weeks ago Beijing reported that a remarkable V-shaped recovery had taken place as the country’s official manufacturing and service PMIs soared in March…

That’s right, blame record collapse on the virus. Forget the billionaires and ghost cities. Forget the plague of protests that have been ravaging China on a yearly basis.

Another incentive for the world’s governments to cooperate with the CV swindle is liquidity as We reported in a previous post. Central Banks are out of money.

The US mortgage industry also has reason to welcome CV. Another mortgage bubble is exploding. Nothing significant was done to stem the practices that brought on the last housing crisis. Forbes contributor Jesse Colombo wrote, “I believe that the U.S. economy was already heading for a recession and that the CV pandemic has acted like a ‘pin’ that burst nearly all of the bubbles that I was warning about.” That handy virus again.

Hedge Funds Collect Like Small Business

CV is also a godsend to the hedge fund industry. Over the years it has been miraculously successful employing a mysterious alchemy that helps them to repeatedly beat the market, and to which no one is privy, not even oversight. But now the magic has run out. The NY Times reported in February 2019

. . . the bloom may be coming off the hedge fund rose. In the past couple of years, as overall returns have lagged broad indexes, investors have grown increasingly concerned about exorbitant management fees, excessive secrecy and illiquidity in the arrangements. The result: The number of hedge funds is declining, and so are the fees managers charge.

. . .

Now, many of these funds are closing. According to the research firm HFR, during the first three quarters of 2016, hedge fund liquidations totaled 782, on track for the highest number since the 2008 financial crisis. The number of new hedge funds was also down in the period.

Thanks to CV, hedge funds can now collect like any small business “just like hair salons, restaurants and dry cleaners” according to some Hedge fund managers. Many of these billion dollar concerns have far fewer than 500 emplyees making them eligble to collect from the Small Business Adminstration’s stimulus pittance package of $349 billion.

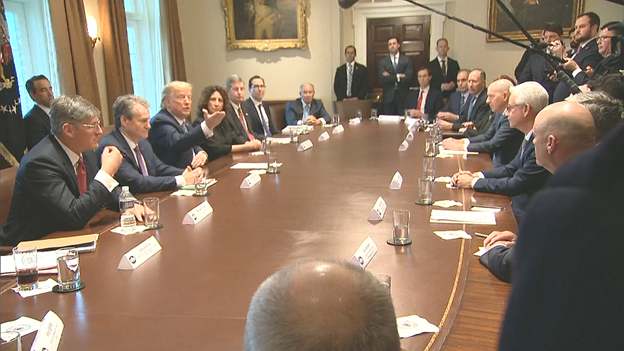

Predictably that money has been quickly gobbled up by said hedge funds and other big business. Neither liberals nor conservatives — neither Chuck Schumer nor Steve Mnuchin said much about this broad daylight robbery. And Schumer was also sure to stress their bipartisan agreement on expanded funding for the small business Paycheck Protection Program to the tune of $310 billion. The Democratic Wall St senator said he and his “rival”, Republican Treasury Secretary and Goldman Sachs alum, also known as the foreclosure king, Steve Mnuchin “came to an agreement on just about every issue”, including, apparently, ignoring the looting by big business. But not quite. Schumer is aware of the plight CV, not the ruling agenda, has put on small business:

“We insisted that a chunk of the money be separate from the competition with the bigger companies, you know the ones that have two, three, 400 people and a relationship with the banks, and we got $125 billion that will go exclusively to the unbanked,” he said. “To the minorities, to the rural areas and to all of those little mom and pop stores that don’t have a good banking connection and need the help.”

More feeding at the trough for the big guys, mom and pops get $125 billion to split among themselves. $125 billion to small business, that means $185 to be gobbled up by anybody else, and they assume big business will take that. This is small business assistance American style.

Mnuchin said, “I think the entire package provides economic relief overall for about 10 weeks.” Tell that to a NY worker collecting $504/week max in unemployment and a one time check of $1200.

BlackRock to the Resuce

Meanwhile Private Assest manager BlackRock will handle the Fed’s distribution of the “corporate slush-fund” “stimulus” worth over 2 trillion dollars (to be leveraged up to $5 trillion). In March 2016 the Intercept reported BlackRock boss Larry Fink was on Obama’s short list to replace Geithner at Treasury, and was said to be one of Hillary Clinton’s considerations for the post. More bipartisanship to take advantage of this “disaster”.

BlackRock is the largest asset manager in the world, managing $7 trillion for clients. Fink manages $20 trillion more for clients through BlackRock’s financial risk-monitoring software called Aladdin (how is that even possible?). Now he manages Trump’s stimulus package, alongside, the foreclosure king and Treasury secretary Steve Mnuchin, and he gets to do it without much accountability.

The Intercept provides a textbook list of revolving door minions Fink brought together in his firm (in case anybody was wondering who was running the government). BlackRock bought a piece of Barclay’s and “holds major share amounts in nearly every mega-bank”. They are so enmeshed in the fabric of government and finance that in the 2008 meltdown government and Wall St. went running to Larry Fink of BlackRock:

At the height of the disaster, when the American economy was on the brink, it was to Fink that Wall Street’s C.E.O.’s—including J. P. Morgan Chase’s Jamie Dimon, Morgan Stanley’s John Mack, and A.I.G.’s Robert Willumstad—turned for help and counsel. As did the U.S. Treasury and the Federal Reserve Bank of New York, whose top officials turned to Fink for advice on the financial markets and assistance on the $30 billion financing of the sale of Bear Stearns to J. P. Morgan, the $180 billion bailout of A.I.G., the $45 billion rescue of Citigroup, and those of Fannie Mae and Freddie Mac at $112 billion and growing.

“It’s like the Blackwater of finance, almost a shadow government,” said an executive. It was only proper that all eyes turned to Fink since he was one of the primary “innovators” of the mortgage back securities. “By 2008 this market—of mortgages, and car and credit-card loans,” wrote Suzanna Andrews for Vanity Fair, “purchased from banks, sliced into pieces, repackaged, and sold to thousands of investors—would help bring the economy to its knees.”

But according to Mnuchin this collapse is nothing like 2008. The Martens of Wall Street On Parade disagree,

Mnuchin said “there’s lots of liquidity” and “this isn’t like the financial crisis.” But savvy folks on Wall Street, and readers of Wall Street On Parade, clearly understand that there is not lots of liquidity and this is exactly like the financial crisis of 2008 in terms of mega Wall Street banks losing massive amounts of their common equity capital and being on a liquidity feeding tube inserted by the Federal Reserve.

Well, not exactly like 2008. In 2008 we didn’t have a germ to blame it on.

In Europe, most governments are bypassing management fees and providing direct assistance to business and workers.

Who knows how the highly stressed masses would have reacted to yet another collapse but much bigger and terrifying than 2008? Lucky CV has help to take the heat off.

Dempanic

The collapse of the political order, in some way, is the most disturbing of the systemic failures unfolding today. If anybody needed CV it was the Democratic Party. All those other issues are part of the drama of economic life in ruling class society (even if it is the endgame) but the political order is a comforting psychological part of the infrastructure of the system. Elections and the political represent the core of “freedom” as the masses of the first world know it. Markets go up and down but the (managed) democratic political system is a pillar of “consensus”, authority and order.

The “democratic” order provides diffusion for the masses’ anger against the “failing government”. Without a functional liberal/conservative paradigm the ruling class loses it most embedded and direct form of central authority built up over decades.

The Democratic Party is leading this mission of institutional suicide on behalf of its owners, as the Preservation Society has been writing about its impending death since the 2016 election. Why the Democrats? Because they are the party of most glaring contradictions. At least Republicans weren’t looking for answers but have been trained to merely want “government off our backs” and to blame everybody else except the masters. Democrats, however, were the designated party of civil liberties, labor and the environment — antithetical interests to the ruling class agenda. The liberal targeted the rich with their lip service (kind of). They could afford to promote the interests of the little masses because of the wartime boom and the necessities of labor.

But the economy changed. Gradually the wartime boom solidified into a bloated corporate order. It no longer saw any reason to invest in society. It didn’t need the public anymore. Innovation was becoming increasingly complex and difficult to attain and became the purview of “institutions” and experts. Capitalists only want markets and consumers not uppity labor or competition. Thus once solidified into a network of unaccountable corporate behemoths, the capitalist order in cooperation with its captured government servant did not allow small business to develop and grow.

In 2016 Bernie ripped open the festering wound that had become the Democratic Party. He showed liberals and even conservatives were not afraid of socialists. He made it OK to say “socialism” in public. The election was a turning point. If the Democrats let Sanders do his thing he would’ve been president. One recalls him prevailing in every poll at the time. Most showed Sanders leading Trump by a healthy margin between and 9-15 points. America would have had its first socialist president, and probably a heart attack to boot.

In the recent 2020 saga of primary elections Sanders was again cheated more or less in broad daylight before he fizzled out and came to heel at Biden’s side. Tim Canova provides a good summary of the implausibility of the Biden surge on the Jimmy Dore Show.

In February We said, “The crumbling status quo presents Us with a challenge. We now face a race against time. Can the ruling class implement civil war among the masses before the system loses complete authority over them?” Now the virus comes along and the establishment is saved — sort of. We were wrong about the civil war, so far, but CV was able to bring equal shock to society and provide the same opportunities to change it wholesale as the entire order collapses. The herd masses tend to instinctively run to the establishment when a major crisis hits home. The masses reflexively swallow everything the establishment feeds them. And so the political farce is saved for the time being.

The bigger the lie, the more terrifying the implications, the quicker they run into their masters’ hands. A mere psychological conjuring, a little cooking of the death accounting books has been enough to bring the whole first world to heel. That, you must admit, is great breeding. We have effectively canceled the election and implemented martial law without having to declare it, without one gun in the street.

As society deteriorates, so does the authority of the parties. Can society last longer than the next four years of Trump? If the Democratic Party dies, so to does the Republican Party, and with them goes much establishment authority. Who will drive the herds? Who will the masses follow in these days of shock and awe?

3 Comments

https://youtu.be/t2vqjBtnltI

Who is driving the herd now?

Have you ruling class individuals (not people) lost your mind?

Is this herding ? https://www.youtube.com/watch?v=Hspw7Y1Gc5s&feature=youtu.be

Maybe Biden and her (as cover for Biden) should be our future leaders?

I might even vote.

Team people for the people: https://www.youtube.com/watch?v=zb6j7o1pLBw

vs

Team duplicitous for the people: https://www.blacklistednews.com/article/76875/watch-bill-gates-and-ellen-discuss-vaccinating-7-billion-healthy-people-in-order-to-return-to.html